- 10x Trading Signal

- Posts

- Crypto Trends Chart Book: Understand What is Moving in the Market and Why

Crypto Trends Chart Book: Understand What is Moving in the Market and Why

Signals That Move Markets

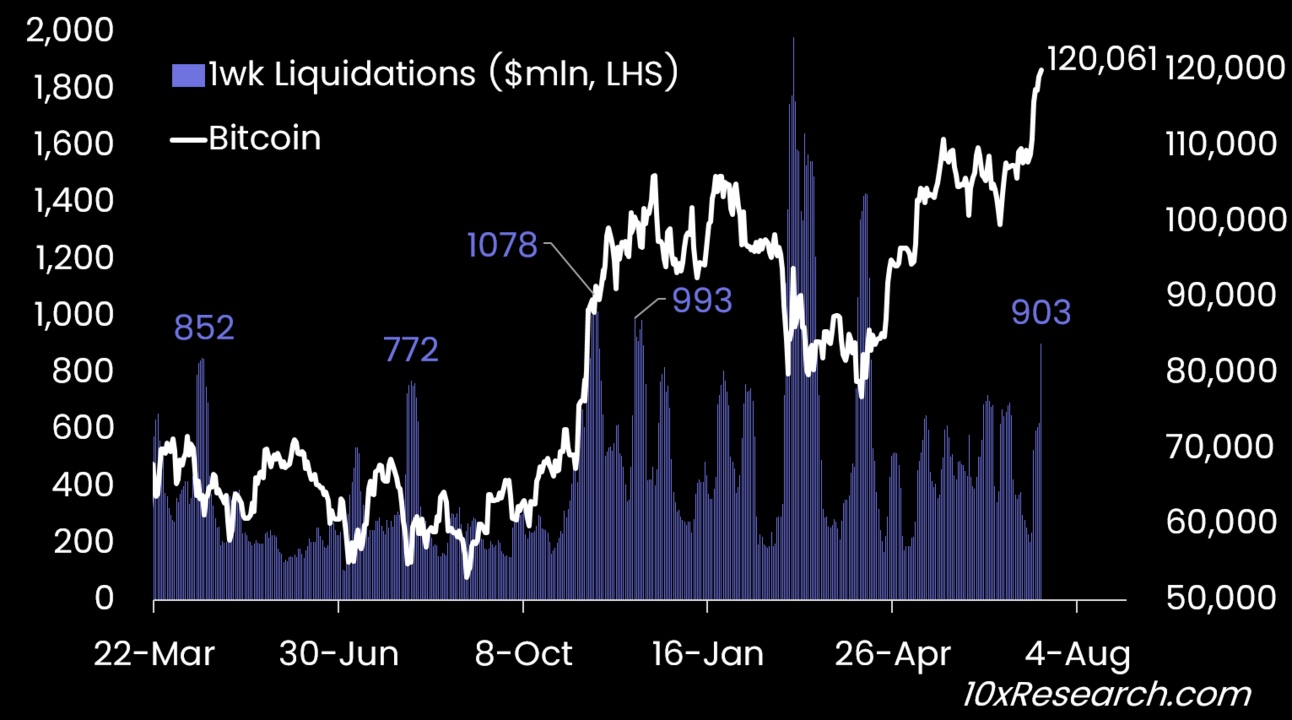

Following the release of the FOMC minutes from June last week, Bitcoin broke out sharply, triggering the largest wave of short liquidations in Bitcoin futures since 2021. This liquidation cascade extended into early Monday Asia hours and coincided with a spike in this week’s altcoin unlock schedule, from $500 million to $1.5 billion. Historically, such large unlocks have been associated with altcoin rallies, and this week’s "Crypto Week" in the U.S. may be fueling expectations of favorable regulatory developments.

Bitcoin saw $903 million short liquidations during the last 7 days

Trading Signals

Become a paying subscriber of Trading Signals to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

Most comprehensive, unbiased digital asset research for traders and institutions:

- • Includes ALL Market Updates (8-16x per month) AND

- • Received a 2 page pdf per Trading Signal (4-8x per month)

- • Based on Top 100+ cryptocurrencies/tokens

- • From 40+ models we run daily

- • Either Long or Short

- • Recommended holding period: 2 weeks, 1 month, 2 months or 3 months

- • Suggested portfolio weight based on volatility adjusted position size

- • Access to 10x Research Trading Signal 'Model Portfolio'

- • --------

- • Although not every signal guarantees success, our models have consistently demonstrated a strong track record. We have honed these models over many years, leveraging our experience at leading proprietary trading desks and hedge funds. Our commitment to continuous improvement ensures they are constantly refined and expanded. These advanced models enable us to analyze the top 100+ cryptocurrencies daily, identifying breakouts, breakdowns, and patterns that lead to high-probability trade setups.